north carolina estate tax certification

North Carolina law requires the Department of Revenue to provide a certification and continuing education program for county assessors and appraisers. Estate Tax Certification For Decedents Dying On or After 1199 Files.

Why Certificates Of Service Are Important Rice Law

Deeds must have grantee address affixed on first page for tax billing purposes.

. Inheritance And Estate Tax Certification North CarolinaStatewideEstate Letters North CarolinaStatewideEstate. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes. Tax Collectors must meet the requirements as set forth in GS 105-349 of the Machinery Act.

Inheritance And Estate Tax Certification PDF 245 KB. The grantor must pay the Real Estate Excise Tax at the time of recording. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99.

What is the estate tax. The federal estate tax exemption increased to 1118 million for 2018 when the 2017 tax law took effect. Estate tax certification north carolina the taxes by way of you and theyll do anything to prisonly finish the identical job including seizing your on-line business and individualal assets.

This form should be completed if the North Carolina Decedent passed away on or after January 1 1999. Link is external 2021. USLF amends and updates the forms.

North Carolina Judicial Branch Search Menu Search. You will then submit the NCDVA-9 to your local county tax office. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291.

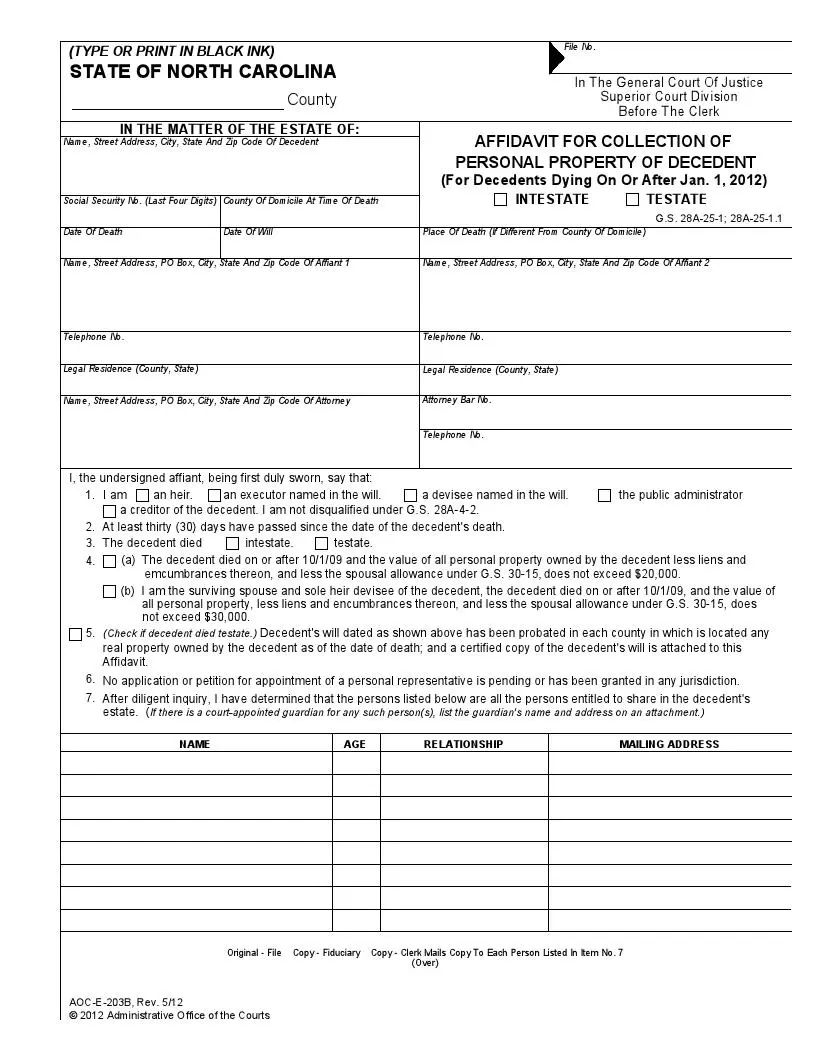

In the matter of the estate of state of north carolina county note. Requirements for Certification by the North Carolina Tax Collectors Association Revised May 9 2012 A. STATE OF NORTH CAROLINA File No.

USLF amends and updates the forms. Inheritance And Estate Tax Certification. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes.

Remember therere abilityed in the ability of intimidation. County Assessor and Appraiser Certifications. Application for Extension for Filing Estate or Trust Tax Return.

The North Carolina County reviewing the tax status of the estate must be reported along with the file number it has assigned to this matter. North carolina estate tax certification under 27 ncac 01d section2301 the north carolina state bar board of legal. Estate Tax Certification For Decedents Dying On.

North Carolina Estate Forms Index. The certification program shall be available to Tax Collectors Deputy Tax Collectors and Assistants support staff. Once certified by the Veterans Benefit Administration the form will be returned to your primary residence.

At least 45 hours shall be in estate planning and probate law provided however that eight of the 45 hours may be in the related areas of elder law Medicaid planning and guardianship. A fee will be due when the account is filed. Find a courthouse Find my court date Pay my citation online.

FOR DECEDENTS DYING PRIOR TO JANUARY 1 1999 Name Of DecedentDate of Death See Side Two GS. Please study the exam topics listed above. This certification must be affixed to the Deed prior to recording.

North carolina law requires the department of revenue to provide a certification and continuing education program for county assessors and appraisers. Owner or Beneficiarys Share of NC. It is first advisable that any business read the North Carolina Solid Waste Management Rules regarding the standards for special tax treatment before applying.

Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399. Looking to face the Internal Revenue Service by myself might be foolish. The following table may be used to verify data in our records for those individuals.

Find a courthouse Find my court date Pay my citation online Prepare for jury service. E-212 Estate Tax Certification for decedents dying on or after 1199 E-214 Certificate Of Service Motion in the Cause to Modify Guardianship E-300 Affidavit of Subscribing Witnesses for Probate of WillCodicil to Will. Deeds must have Tax Certification obtained from the Alleghany County Tax Administrator.

AOC-E 212 OR an Inheritance and Estate Tax Certificate issued by the North Carolina Department of Revenue will need to be completed by the time you file the final account. At least 72 hours of CLE credits in estate planning and related fields. Estate Tax Certification 87 North Carolina County Information.

Its you can youll. 251 North Main Street Room 190 Winston-Salem NC 27155. The tax rate is 200 per 1000 of the purchase price of the real estate.

The deadline to submit your documents to your county tax office is June 1st of the current tax year. Beneficiarys Share of North Carolina Income Adjustments and Credits. Instant access to fillable Microsoft Word or PDF forms.

North Carolina Judicial Branch Search Menu Search. The balance may be in the related areas of taxation business organizations real. Duty to Furnish a Certificate-On the request of any of the persons prescribed in subdivision a 2 below the tax collector shall furnish a written certificate stating the amount of taxes and special assessments for the.

NC K-1 Supplemental Schedule. In the General Court Of Justice. IN THE MATTER OF THE ESTATE OF.

The Property Tax Division of the North Carolina Department of Revenue is the division responsible for this administration. The balance of the exam approximately 40 tests North Carolina state law issues. An Estate Tax Certification Form No.

Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property by taxing units throughout the State. Approximately 60 of the exam tests your knowledge of gift estate generation skipping and income tax rules as these rules pertain to estate planning and estate administration matters. Estate Tax Certification For Decedents Dying On Or After 1199.

Tax Certification Program North Carolina offers a tax exemption on equipment and facilities used exclusively for recycling and resource recovery. If you believe the data in this table is incorrect please notify Dave Duty in the. The following table may be used to verify data in our records for.

Before The Clerk County. Requirements for certification by the north carolina tax collectors association revised may 9 2012 a.

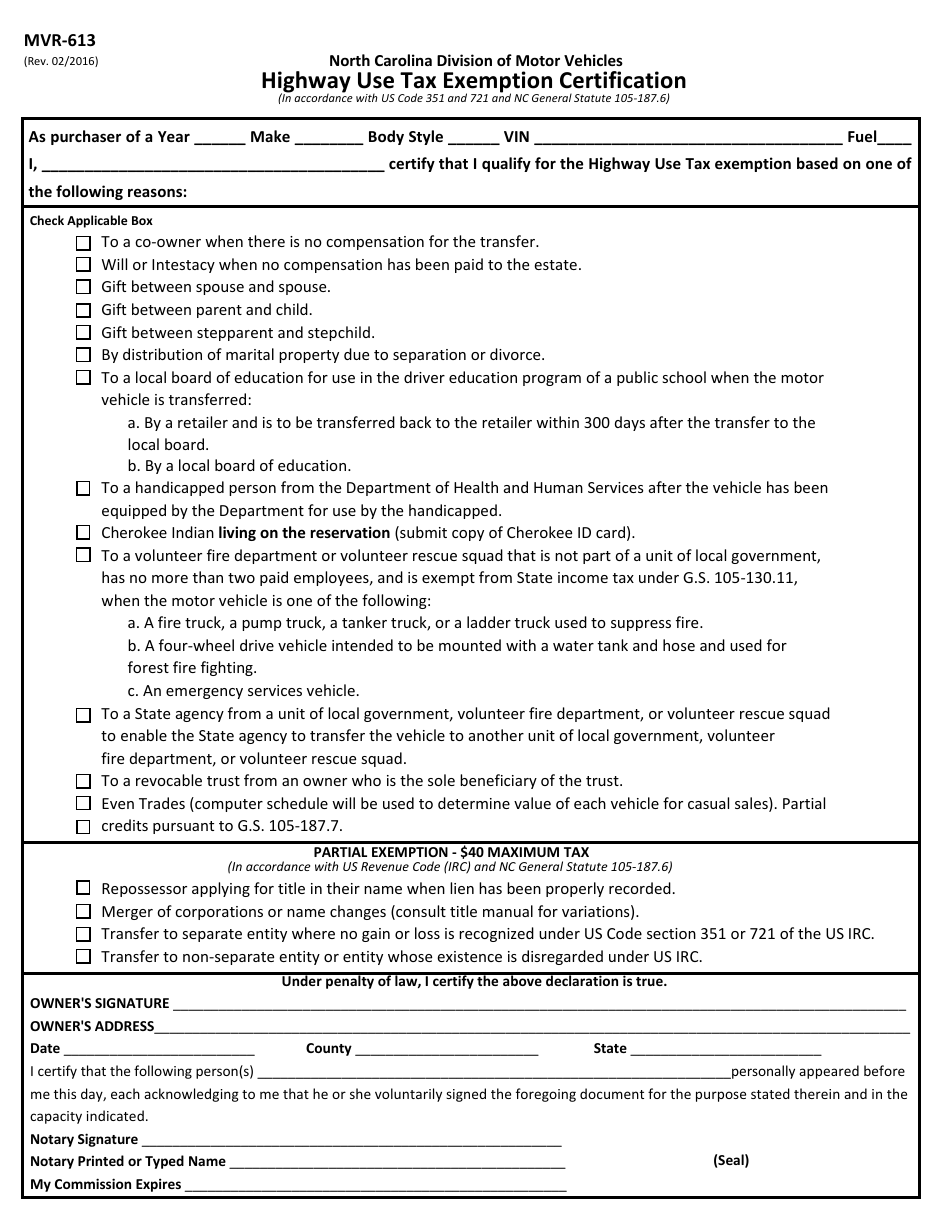

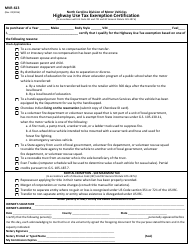

Form Mvr 613 Download Fillable Pdf Or Fill Online Highway Use Tax Exemption Certification North Carolina Templateroller

North Carolina Estate Tax Everything You Need To Know Smartasset

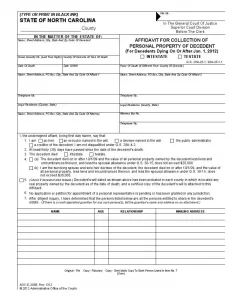

Free North Carolina Small Estate Affidavit Form Pdf Formspal

Tax Listings Personal Property Dare County Nc

Estate Executor Death Checklist Nc Duties To Fulfill After A Death

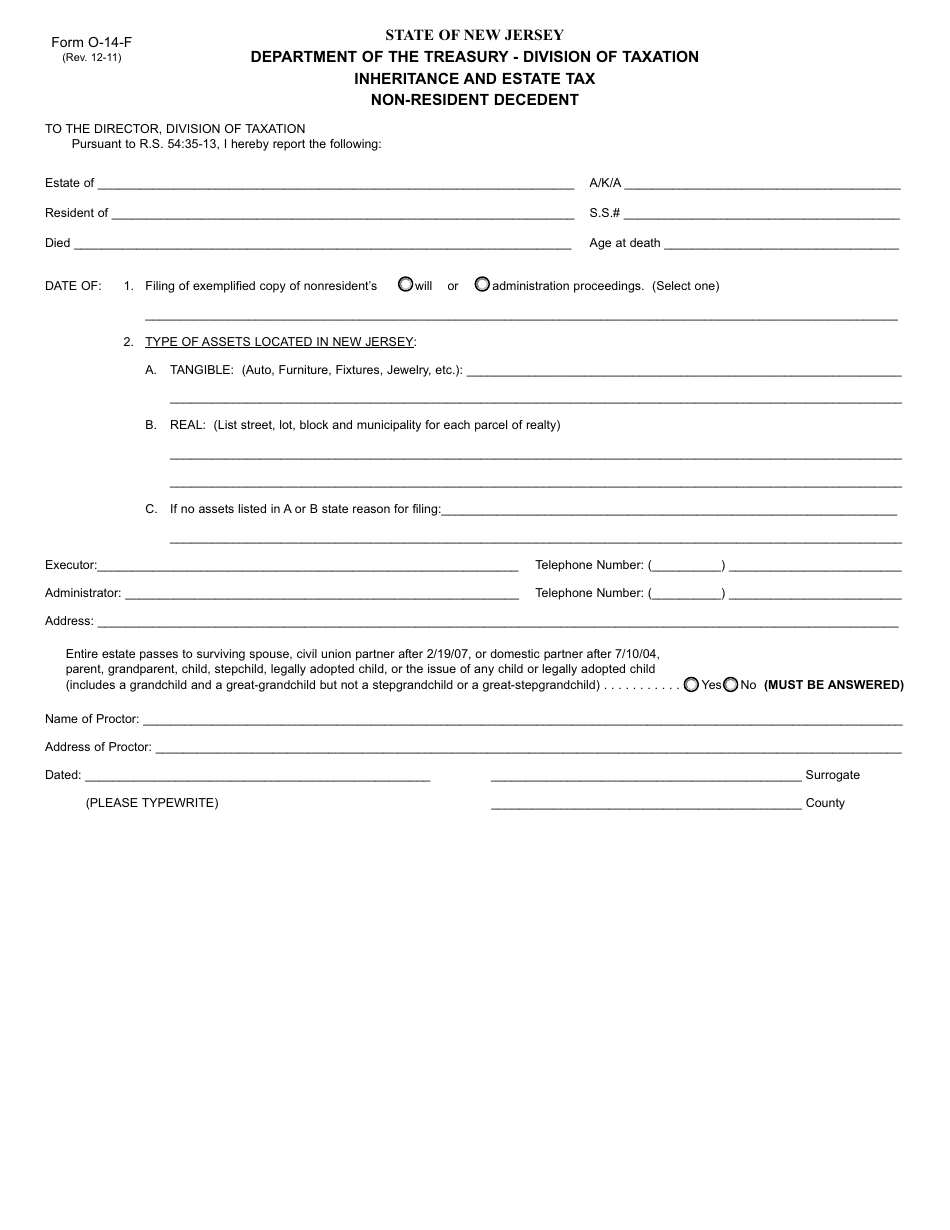

Form O 14 F Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Non Resident Decedent New Jersey Templateroller

North Carolina Estate Tax Everything You Need To Know Smartasset

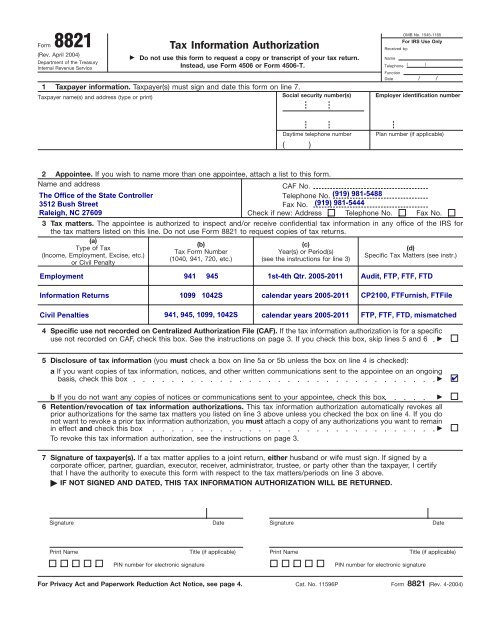

Irs Form 8821 Tax Information Authorization North Carolina Office

Free North Carolina Vehicle Bill Of Sale Form Pdf Word

North Carolina Estate Tax Everything You Need To Know Smartasset

The Probate Process In North Carolina Twiford Law Firm

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Form Mvr 613 Download Fillable Pdf Or Fill Online Highway Use Tax Exemption Certification North Carolina Templateroller

Understanding North Carolina Inheritance Law

Free North Carolina Small Estate Affidavit Form Pdf Formspal